Leave your Legacy in Good Hands.

Enjoy your Next Adventure.

We provide owners an attractive opportunity, with the peace of mind that their legacy is in good hands.

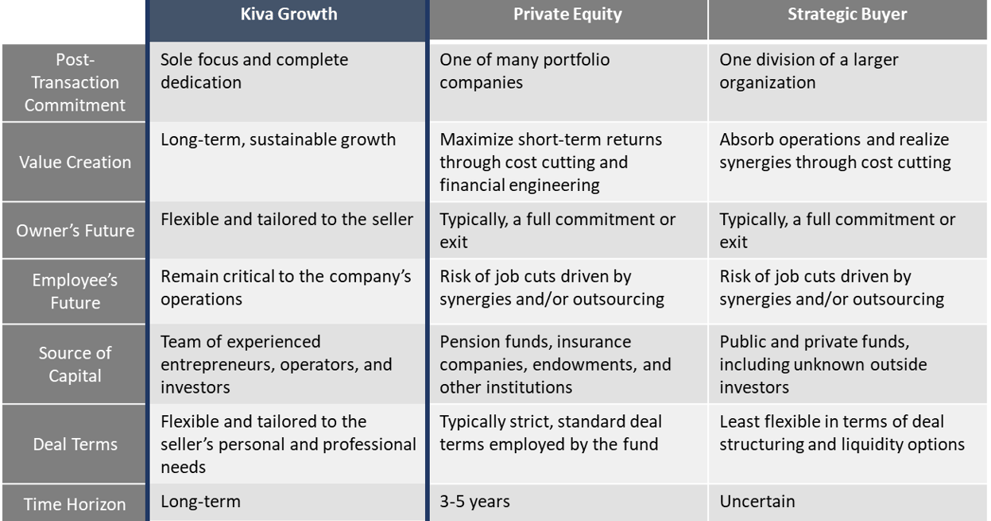

We are an entrepreneur-led investment firm aiming to grow a single company for the long term. The Kiva Capital Partners team includes successful entrepreneurs, CEOs, and middle-market investors, with extensive experience and a track record of enabling long-term performance.

We are seeking to acquire and operate a single business, allowing for a successful exit and stable succession for business owners.

Committed for the Long-Term

100% committed to leading the business for the long term

Your business is our sole focus, with no plans for absorption or short-term profit through cost or staff cuts

Our seasoned CEOs, entrepreneurs, and investors will advise on long-term value creation

Relationship Driven

We value people and relationships above everything

We have experience managing people and operations

We offer flexibility and liquidity as you transition from managing day-to-day operations

Our Partnership will Create Long-Term Value

Differentiated Model

Proven success in AI and tech modernization for enhanced operational efficiency and accelerated growth

We offer you the opportunity to recalibrate your role, move away from daily tasks, and contribute to the business's future direction

We won't renegotiate and grind you on terms

Managing Partner Steve Lee as well as certain key team members will join senior management post-acquisition to preserve your legacy and build upon the incredible success you have established

The Kiva Difference: Focused on Your Business and Legacy

Industry Criteria

Sizeable and growing industry

Fragmented landscape

Low business cycle exposure

Business Criteria

Recurring / contractual revenue

Defensible competitive advantage

Diverse, loyal customer base

Kiva Capital Partners is seeking a high quality business that satisfies the following criteria:

Financial Criteria

Positive cash flow

History of profitability and growth

Majority Transaction

Experienced Team with a Track Record of Success

Steve Lee

Steve comes from a family of entrepreneurs and understands the importance, commitment and accountability in being an owner. Steve brings nearly two decades of professional work experience, and his background in investment banking, consulting and being an entrepreneur combined with his demonstrated leadership ability, positions him well to successfully lead and run a company.

Steve most recently served as an investment banker at Morgan Stanley with a focus in Industrial Technology and Financial Sponsors. Steve also has 10+ years as a management consultant advising clients in M&A, growth strategies, and organizational transformations, and AI/RPA tech modernization across Tech, Healthcare, B2B Services, Consumers, and Industrial sectors. Steve has advised many top-tier organizations including Amex, Genentech, Pfizer, BofA, Prudential, Salesforce, Sterling, Cornerstone on Demand. Lastly, Steve has founded, operated and/or advised several companies within EdTech, Real Estate, and B2B audio services.

Steve earned a BS with honors from Pennsylvania State University and his MBA from UC Berkeley Haas School of Business.

Investors AND Advisory Team

Kiva Capital Partners' investors and advisors include successful entrepreneurs, CEOs and business leaders who have collectively invested in 150+ small businesses across B2B services, healthcare, and software. They look forward to meeting and working with you!

Founder & Managing Partner

Successful team of experienced operators

Andy Love Former CEO of Behavioral Health Group

Andrew Saltoun Chairman of CampMinder & Cambridge Spa

Badge Stone Former CEO of Perimeter Security Systems

Doug Tudor Former SVP for Asurion

G.J. King Former President of RIA in a Box

Hiten Varia Chairman and founder of m9 Tech Solutions

Jeff Stevens Former CEO to 3 B2B companies

Raymond Fan Former CEO of Skin & Beauty Center

Mahesh Rajasekharan Former CEO of Cleo Communications

Todd Tracey Former CEO of HemaSource

Will Bressman Former CEO of RIA in a Box

Will Thorndike Author of Outsiders and Founder of Housatonic

Meet The Family

Meet Steve's better half Connie, a born-and-raised San Franciscan who's been saving lives in the Neuro Trauma ICU at SF General for a decade. While Steve's out meeting owners, he has his own in-house healthcare expert to bounce medical investments off of. (Though let's be honest, after 10 years in the ICU, Connie's probably seen enough drama to fill a season of Grey's Anatomy!)

When they're not working, you'll find these two adventure seekers carving up the slopes, trying not to lose golf balls in the rough, hitting hiking trails, or checking national parks off their bucket list. And if you're lucky, you might catch Steve channeling his inner Kenny G on the saxophone or reliving his DJ glory days. Just don't ask him to play "Careless Whisper" - or do, we're not sure which would be funnier!

30 Min Intro Call: Get to know each other and discuss your goals

Meet in Person and submit initial offer (48 hours): Learn more about your business and future plans

Letter of Intent (1-2 weeks): Agree on price and key terms

Diligence and Transition Planning (60 Days): Collaborate to build a successful transition plan

Deal Closed

Selling your business is a career-defining moment. We emphasize building trust and navigating the process hand-in-hand with you. We move quickly and with full confidentiality, seeking a fast, lucrative exit for you.

Our Process

Get in touch

Please reach out with any questions - or if you'd like to discuss our future together!

Phone

650.204.1631

admin@kivacapitalpartners.com